Loxon is a trusted business solutions provider with more than 20 years of experience in the field of end-to-end credit management. We are offering comprehensive, integrated lending, collection and risk management solutions for the financial services industry.

collection MEANS

connection

enhanced customer experience

- Request a demoRequest a demo

- Learn more

Our business solutions

We provide high quality tools for financial institutions to boost their digital transformation processes in the lending ecosystem, while focusing on their operational efficiency, improving their customer's onboarding processes and simplifies their back-office operations to make positive impact on their business.

Leveraging over two decades of expertise, our

comprehensive End-to-End Debt Collection

Business Solution empowers you to gain a

competitive edge, realize cost savings, and

enhance operational efficiency. Embrace our

expertise and collaborate with us to establish a

reimagined customer-centric collection

ecosystem.

Rigorous risk management standards, which have

recently coincided with increasing complexities and

evolving threats in the global landscape, underscore

the paramount importance of effective risk

management in today’s financial institutions. Rest

assured, our comprehensive Risk Suite will equip

you with the tools and expertise to navigate these

challenges confidently and emerge stronger and

more resilient.

Oracle Practice

OFSAA (Oracle Financial Services Analytical Applications) is a suite of integrated banking analytical applications for Enterprise Performance Management (EPM), which helps you to meet your risk adjusted performance objectives.

Keep up to date with the latest information about Loxon!

For news, insights, events and all the latest info you need to know about us.

Pick a topic below and stay well informed.

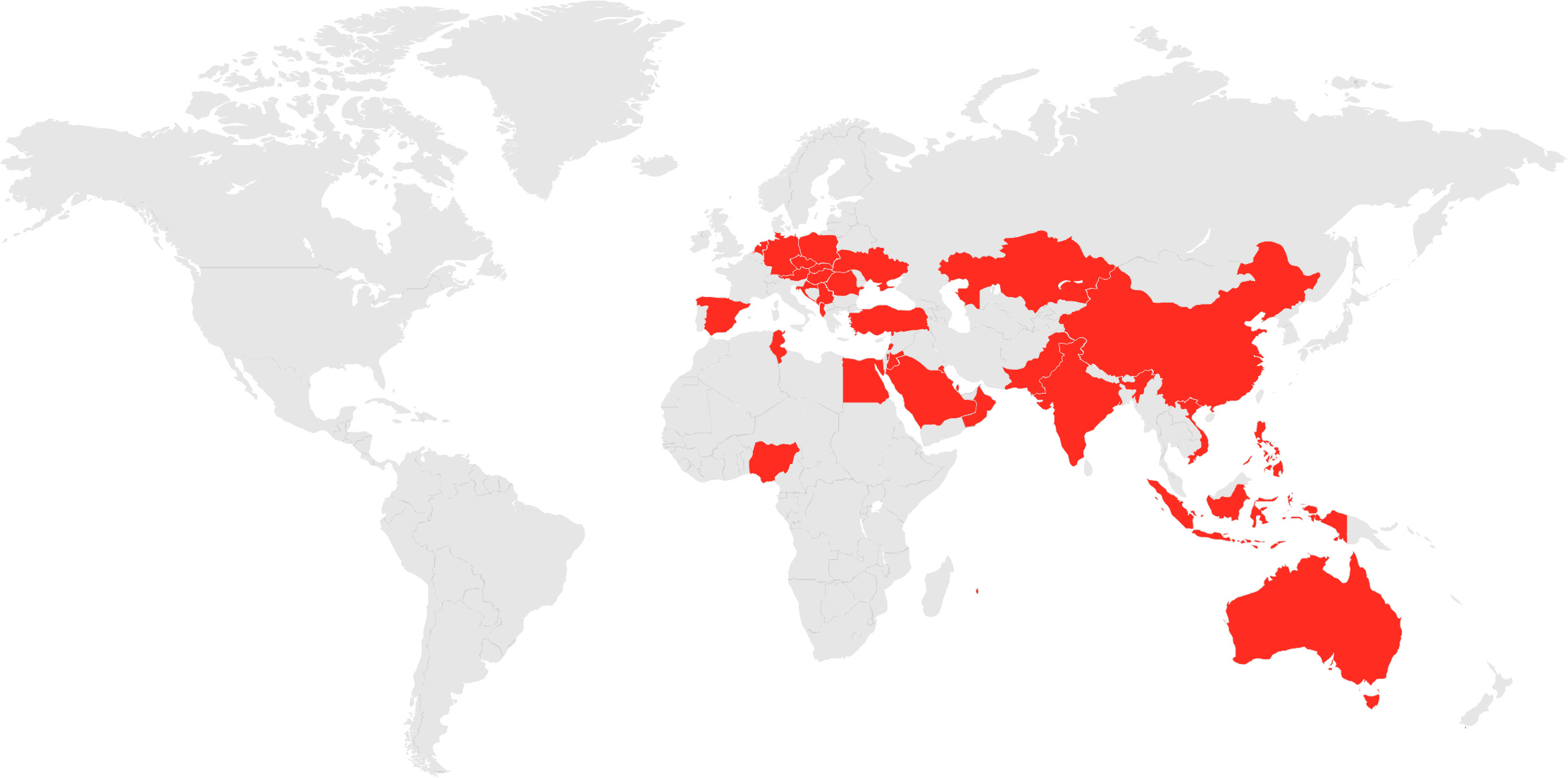

30 countries covered by Loxon projects

Loxon is one of leading provider of the risk management and lending software market in the CEE, APAC and MEA regions.

Our valued customers

Testimonials

Loxon in numbers

We would love to hear from you

Let us find the best credit management Business Solutions for you. Our seasoned professionals would love to contribute their expertise and insights to your next big project.